About Me

Combining emotional intelligence with advanced analytics to drive meaningful connections and data-driven insights that transform business outcomes.

I'm a Master of Science in Business Analytics graduate from SC Johnson School of Business who enjoys turning complex data into clear, actionable insights. My leadership experience comes from coordinating cross-functional teams, and my Lean Six Sigma Black Belt and Champion credentials aren't just fancy letters after my name; they're my toolkit for creating order from chaos and turning "good enough" into "absolutely exceptional."

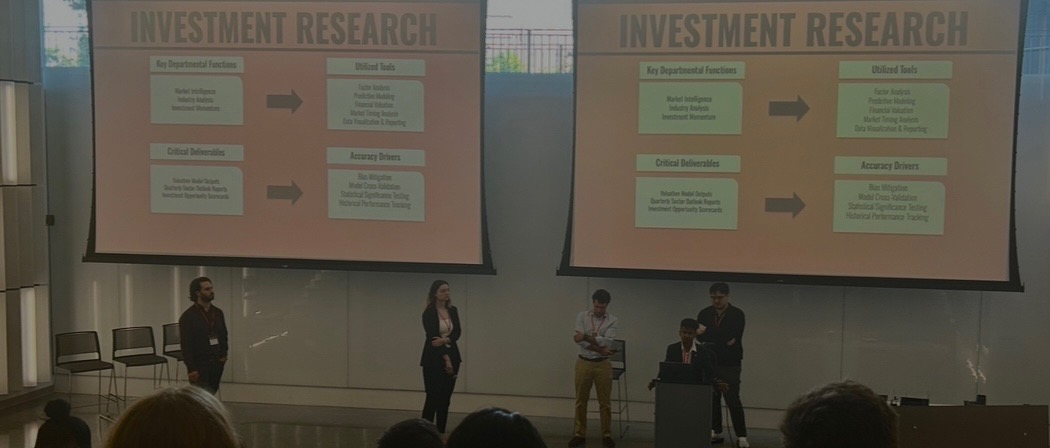

At Cornell, I found my sweet spot balancing technical innovation with community building. As Co-Chair and Head of DeFi and Blockchain for our MSBA Quantitative Finance Group, I connected academic research with practical financial applications. As Co-Chair for the Event Management Committee, I created meaningful experiences for our cohort and alumni, because strong relationships are just as valuable as strong analytical models.

My expertise includes financial analytics, business intelligence, product-focused development, and data-driven decision making, supported by hands-on experience with programming languages and analytical tooling. I am highly engaged in the work I do and enjoy collaborating with stakeholders to translate complex data into clear, actionable insights. I design and build analytical products with a focus on efficiency, scalability, and usability, ensuring solutions are practical, maintainable, and aligned with real business needs. I combine analytical rigor with strategic thinking to develop platforms, financial models, and community tools that bridge innovation with real business value.